Adam Smith Award for Best Supply Chain Solution

Scorpio, in collaboration with Citi, has won the Best Supply Chain Solution award at the Adam Smith Awards 2024 by Treasury Today Group.

This prestigious award is acknowledged as the ultimate benchmark for corporate treasury achievement. 2024 saw 389 nominations from 34 countries. The Best Supply Chain Solution category honours outstanding solutions in import/export trade and the supply chain, recognizing innovative approaches that enhance the relationship between buyer and seller.

Representing Scorpio at the awards ceremony in London on June 26th were (from left to right) Micha Withoft, Senior Legal Counsel, Alessandro Griselli, Chief Financial Officer and Paola Maggioni, Head of Corporate Control, along with Akim Kibalnik, Vice President, Natural Resources, Trade, and Working Capital Sales, UK and Europe, Citi.

The award was in recognition of how Scorpio Pools deliver working capital benefit to pool participants and charterers.

THE CHALLENGE

In the shipping sector, vessel owners often have limited ability or scale to negotiate with clients and service providers. This means synergies in the market are missed, along with the opportunity to improve market access, maximise vessel employment and improve efficiency.

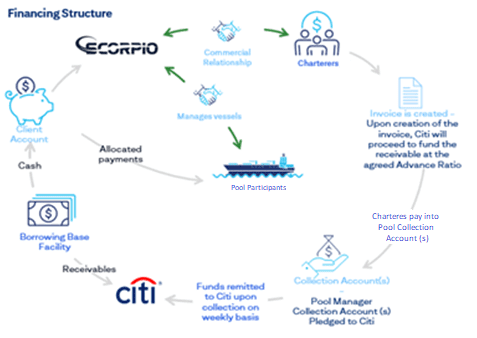

To address fragmentation and increase scale and efficiency, vessel owners / disponent owners join pools such as Scorpio LR2 Pool. This pool of LR2-type tankers provides marine transportation of refined petroleum products. Shipping pools consist of several vessels from various disponent owners – so-called pool participants – placed under the management of a Pool Manager to oversee running the vessels and ensuring their utilisation.

Spot/time charters are collected into the pool account, which is used to pay for any voyage costs and make distributions to participants.

Vessel charterers, Scorpio Pool’s customers, are oil majors and national oil companies wanting to ship their goods. They purchase shipping services on open account and receive payment terms of up to 150 days depending on the type of receivables. At the same time, Scorpio Pool covers voyage costs, and makes distributions to pool participants ahead of receiving funds from their customers.

THE SOLUTION

Given the pool does not have any assets apart from working capital, accounts receivables, and pre-payments cash, Citi and Scorpio needed to identify a robust security structure. Cue a solution that provides working capital access to the shipping pool, allowing for greater participation levels within the pool and for pool participants to receive cash ahead of the completion of the delivery. The solution also supports the ability to contract with customers who require payment terms, thus expanding supplier and customer bases simultaneously.

“Citi and ourselves launched a Borrowing Base Facility in the beginning of 2024, providing a flexible working capital solution to bridge mismatches between vessel voyages and payout to pool partners,” explains Paola Maggioni, Head of Corporate Control.

As a result of the close collaboration between Scorpio and Citi, a tailored shipping pool structure was developed. Facility benefits for Scorpio include:

Industry accepted tenors – not beyond 90 days for freight-in-transit and freight receivables and 150 days for demurrage receivables, allowing Scorpio to contract with oil majors, national oil companies and large trading houses.

Flexible financial covenant – industry specific working capital covenant, calculated as a multiple of vessels under management, which changes based on Scorpio’s ability to continue to do business with existing but also new Pool participants.

Manageable advance ratios – subject to the type of receivable, but not beyond 75% for freight-in-transit receivables, 90% for freight and 80% for demurrage receivables as a safeguard for proposed facility.

BEST PRACTICE AND INNOVATION

This solution allows the business model to operate unchanged with improved cash flows through working capital optimisation. The flexibility of the structure meets Scorpio’s needs but also includes a regimented risk operating model. It is future scalable, deploys a simple implementation process and the funding has capacity and flexibility.

KEY BENEFITS

- Cost savings.

- Process efficiencies.

- Return on investment (ROI).

- Improved visibility.

- Future-proof solution.

- Improved key performance indicator (KPI) metrics.