Blockchain: Potential Implications for Marine Insurance

Interest in blockchain has risen and then waned as it failed to gain mass adoption. However, the intellectual capital, and collective energy invested in the development of blockchain means that a tipping point is inevitable. This is the so-called Amara’s law which states that “we tend to overestimate the effect of a technology in the short run and underestimate the effect in the long run”.

As has the internet done for the exchange of information, blockchain is an infrastructure technology that will enable a peer-to-peer instantaneous exchange of value.

Once mature and adopted en masse, it has the potential to be disruptive – among the others – to the insurance industry’s existing business and operating models.

This article looks to shed some light on this technology and illustrate some potential implications on the marine insurance industry.

What is blockchain technology?

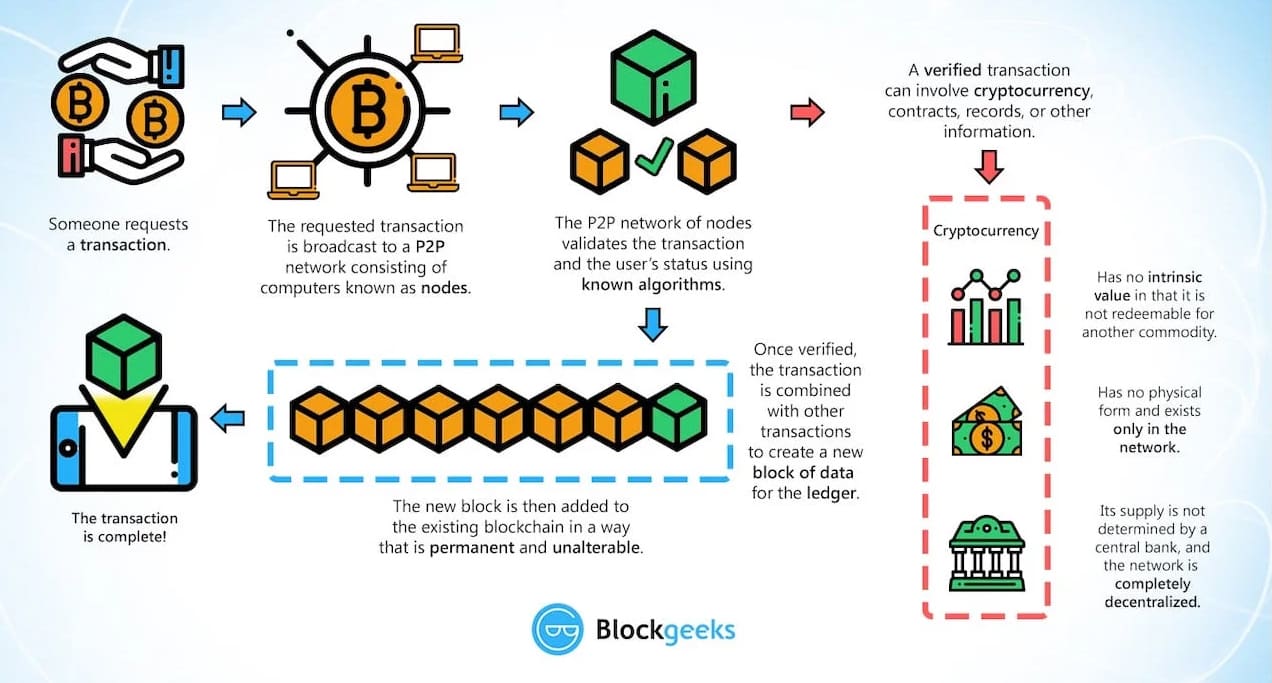

Blockchain is a ledger of transactions and data that is stored on multiple machines. While most traditional databases are housed on one centralized server, which is vulnerable to hacking, the storage of data on multiple computers (nodes) removes any single point of failure and control, and makes records almost incorruptible, while entries and changes are explicable and traceable.

Transactions or changes are only processed after several confirmations of the network, ensuring that every addition follows the parameters of

the network. As such, this minimizes the risk of fraudulent activities.

Benefits of blockchain application:

- Transparency & Immutability (it is like etching the data into stone)

- High availability & Decentralisation

- Enhanced security & Faster dealings

- The creation of an un-editable true digital representation to ensure faultless tracking of an unaltered physical object

- Cutting out the layers of intermediaries in international commerce

- The ability to standardise paper-based documentation used for import and export and connecting them on a single digital string.

Risks and challenges:

As is the case with adopting any new technology, there are risks and challenges that need to be considered when adopting blockchain as an enterprise solution. These issues are not only related to technology, but also with business strategy and culture, processes, regulation and financial costs.

- To be truly effective all participants in the supply chain must be integrated with the system.

- This can create problems where you are dealing with countries and individuals that are less technically developed.

- The marketplace has become so competitive that start-ups are making unverifiable claims and trying to outdo each other so it’s extremely hard to know what is and what is not technically and economically viable.

A common feature amongst successful blockchain use cases is that business partners are willing to collaborate. Companies need to be prepared to both cooperate and compete on the same network so that everyone benefits. Many would struggle to embrace this new thinking and the challenges may include the risk of sharing commercially sensitive data, leading to a loss in competitive advantage as well as the lack of support from within the organization due to a natural reluctance to change – New technology often means changing mindsets and existing processes.

Creating a culture which encourages innovation and continuous improvements is no small task!

From a legal/jurisdictional point of view, legislation and regulation have generally not caught up with developments in the blockchain space.

Indeed, due to blockchain ledgers’ non-specific location, transactions may potentially be subject to the jurisdiction of any given node in the network. It may be difficult to pinpoint which country has legal jurisdiction in the event of a dispute.

The lack of physical connection to any one jurisdiction may result in certain countries’ courts being willing to seize jurisdiction even in the face of an exclusive jurisdiction clause.

It is yet unclear whether smart contracts would be recognized as a formal legal contract.

Potential Applications to Marine Insurance Industry:

Currently, the distribution of marine insurance consists of ship owners, operators, brokers, insurers and re-insurers. This convoluted process involves multiple intermediaries with much information lost in the process.

By removing third party intermediaries and overhead costs for exchanging assets, blockchains have the potential to greatly reduce transaction fees.

There is one thing, however, not to be overlooked. The negotiation aspect, whether related with underwriting dealing or with complex marine claims environment, seem to be a major stopper for an immediate adoption of such technology. So, the “human being” and “broking” factors involved with these activities seem to be un-alienable, at least for the time being.

Blockchain and Bills of Lading:

Several major oil companies, traders, and banks are considering blockchain technology for handling bills of lading. This innovation might reduce paperwork, cut costs, and eliminate errors, eventually resulting in higher profits. Companies have already conducted experiments with their blockchain platform for physical commodity trade.

Blockchain and P&I cover:

As blockchain technology is relatively new and not yet comprehensively regulated, it is difficult to assess how and to what extent the shipping and insurance industries will adopt and regulate this technology. It may be some time before the technology and its impact are discussed fully by the International Group of P&I Clubs.

While the development of Blockchain and e-commerce is moving at the speed of a bullet the legal and regulatory regimes are still getting their tandem out of the bicycle shed.

It remains to be seen how an increased use of blockchain in cargo-related transactions might alter P&I and other related marine cover in the future.

Apportioning liability and disputed claims:

There may be difficulties in apportioning liability in smart contracts. Smart Contracts consist of a set of instructions that self-execute as opposed

to a natural written contract with prescribed legal consequences. Difficulties in programming a smart contract to take into consideration the nuances of liabilities and attribute an exact apportionment of contributory negligence to each party is one example.

By way of practical example, the reason for a cargo temperature having exceeded the specified threshold may be due to the crew’s negligence in monitoring the temperature during the voyage or the shipper’s failure to provide clear instructions about how to handle it.

Therefore, the apportionment of liability in this scenario may not be an exact science and, as such, not readily quantifiable based on the rigid parameters of a smart contract.

Blockchain and potential applications to War Risks:

Traditionally, when a ship is planning to enter a zone where the premium needs to change, the ship operator would inform brokers who would then notify the insurer. Blockchain can be of assistance meeting Industry’s needs, with a preconfigured GPS which will signal the intended route in advance and a smart contract will be issued by the insurer based on location co-ordinates that can be authenticated through an offline ‘oracle’. Oracles are a central feature of blockchain architectures. The existence of this oracle represents the key differentiator of blockchain based use cases for marine insurance compared to blockchain use cases for other lines.

Conclusions:

In an ideal situation, blockchain technology enables the use of smart insurance contracts, which are non-paper based, self-executing, unambiguous, involving all relevant parties concurrently with zero-fraud and error. However, at present, Blockchain must not be seen as a magic potion for all cost-and-efficiency-related issues.

Cryptography-based trust models will bring new and unforeseen risks, so companies will need to consider appropriate changes in their risk management strategy and governance models.

Not all “Smart Contracts’ are fully recognized in court, although many states and countries are reportedly working toward IT solutions.

It would seem that until the technology gains wide acceptance and addresses the outstanding concerns, insurers are likely to continue concluding separate contracts with their assured in order to accurately capture the parties’ rights and obligations.